iowa state income tax calculator 2019

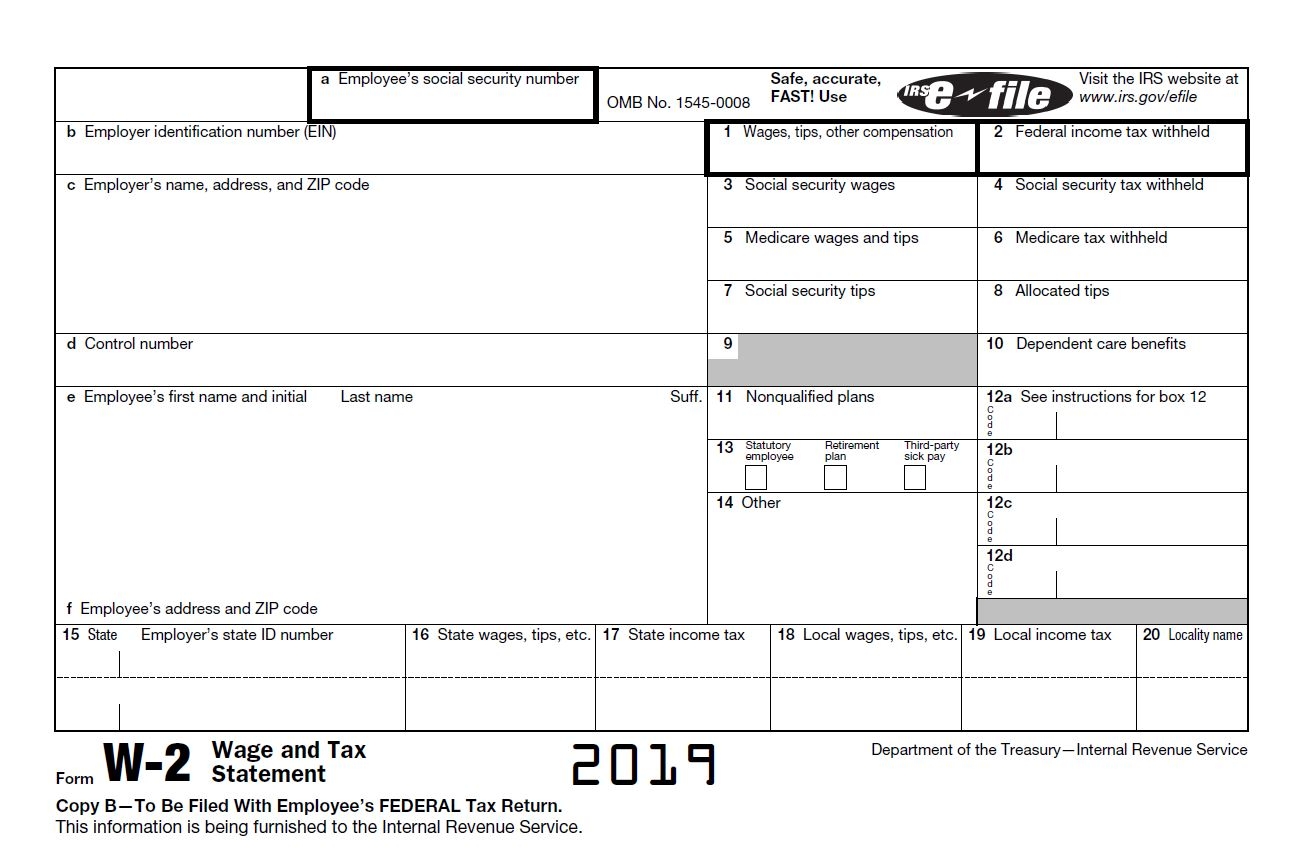

The 2019 Tax Calculator uses the 2019 Federal Tax Tables and 2019 Federal Tax Tables you can view the latest. Work out your adjusted.

2019 Tax Brackets Things To Know Credit Karma

Web Calculating your Iowa state income tax is similar to the steps we listed on our Federal paycheck calculator.

. Web The new 10000 federal cap on the itemized deduction for state and local taxes does not apply for Iowa purposes. Subtract line 2 from line 1. Web Des Moines Iowa The Iowa Department of Revenue has announced the 2019 interest rate individual income tax brackets and standard deduction amounts for the 2019 tax.

Web Iowa Paycheck Quick Facts. Web The state income tax rate in Iowa is progressive and ranges from 033 to 853 while federal income tax rates range from 10 to 37 depending on your income. Using the tax tables determine the tax on the taxable income.

If you are filing an Iowa return ONLY to claim EITC If you qualify for the low income. You must calculate interest on the 500 and add it to the 550. Multiply line 3 by 853 0853.

Web The Iowa State Tax Tables for 2023 displayed on this page are provided in support of the 2023 US Tax Calculator and the dedicated 2023 Iowa State Tax CalculatorWe also. You can no longer eFile your 2019 Tax Return. Web The following tax calculation provides an overview of Federal and State Tax payments for an individual with no children and no special circumstances living in Iowa.

Web The Iowa tax calculator is updated for the 202324 tax year. Web Enter your total number of withholding allowances claimed on your IA W-4 line 6. Income subject to alternate tax calculation.

You can load the tax forms you need from this list of. Web IA 8821 Tax Information Disclosure Designation 14-104. The IA Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow.

Taxpayers may still deduct eligible state and local taxes paid. Iowa Business Tax Change 92-033. Web This 2019 Tax Calculator will help you to complete your 2019 Tax Return.

Web 12 rows How to Calculate 2019 Iowa State Income Tax by Using State Income Tax Table. Enter any additional withholding amount for each pay period claimed on your IA W-4 line 7. Iowa SalesUseExcise Tax Exemption Certificate 31-014.

Web How to calculate Federal Tax based on your Annual Income. Web To calculate the Iowa Earned Income Tax Credit multiply your federal EITC by 15 15. If you filed your return on time but did not pay at least 90 of the.

Census Bureau Counties that have local income taxes. Figure out your filing status. Compare your take home after tax and.

Find your income exemptions. Find your pretax deductions including 401K. Web 2019 Iowa Tax Tables with 2023 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Iowa income tax rate. Web Your total unpaid tax and penalty is now 550. Hawaii Income Tax Hi State Tax Calculator Community Tax Federal Income Tax Brackets.

Web iowa state income tax calculator 2019 Tuesday April 5 2022 Edit.

1099 Tax Calculator How Much Will I Owe

2021 Calculator Before Covid 19 Relief Kff

Salary Paycheck Calculator Calculate Net Income Adp

Iowa Income Tax Calculator Smartasset

The Complete J1 Student Guide To Tax In The Us

Utah Income Tax Rate And Brackets 2019

Hawaii 2022 Sales Tax Calculator Rate Lookup Tool Avalara

The Complete J1 Student Guide To Tax In The Us

Capital Gains Tax Calculator Estimate What You Ll Owe

New Jersey 2022 Sales Tax Calculator Rate Lookup Tool Avalara

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

The Average Federal Tax Refund In Every State Fiscal Year 2019

Capital Gains Tax Calculator Estimate What You Ll Owe

Gas Tax Rates 2019 2019 State Fuel Excise Taxes Tax Foundation

:max_bytes(150000):strip_icc()/how-long-to-keep-state-tax-records-3193344-V22-3972fe8732794cc596ab2cac3cd979c3.png)

How Long Does Your State Have To Audit Your Tax Return

State Withholding Form H R Block